Every four years there is an event that miners and bitcoin (BTC) followers alike look forward to: halving. A protocol written into bitcoin’s code, it largely determines the future of the cryptocurrency – and helps drive price fluctuations.

Many big events take place every four years: whether it’s the Euro soccer tournament, leap years, or the Summer Olympics, many fans look forward to the next one every time. For miners and cryptocurrency enthusiasts, this is the halving of bitcoin (BTC).

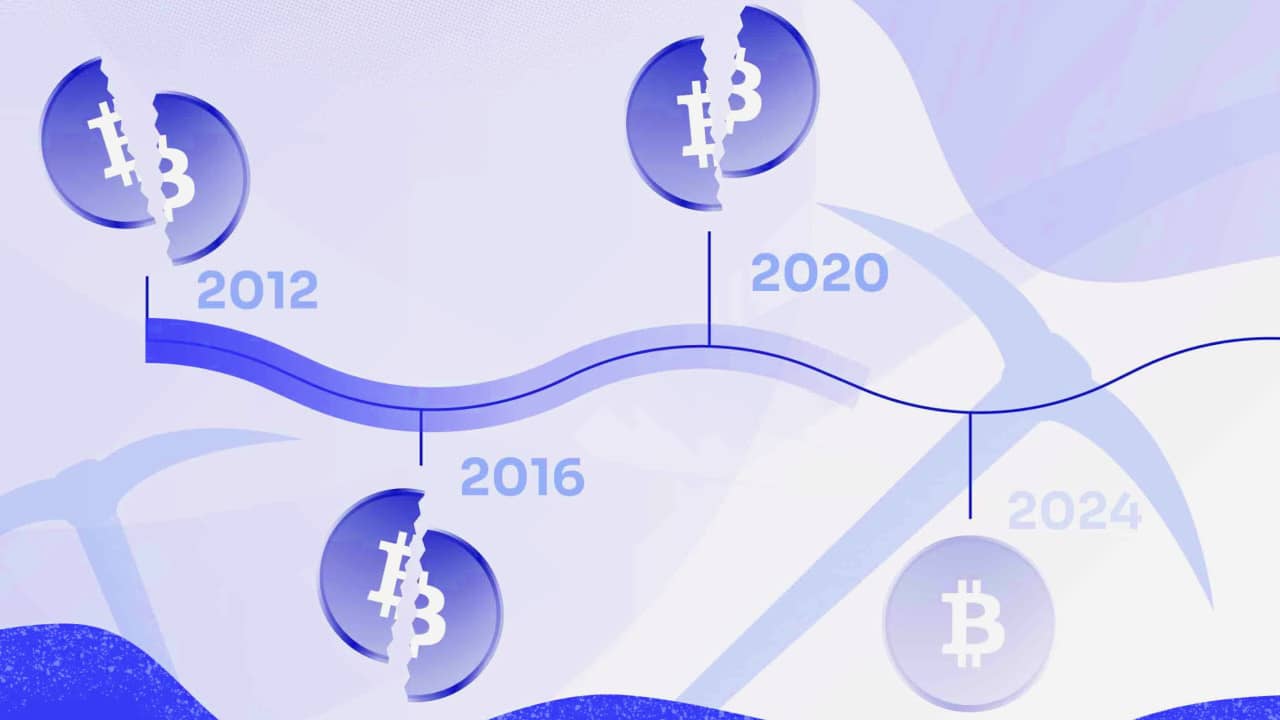

Since bitcoin’s inception in 2008, there have only been 3 halvings, the last one in May 2020. Although it is a fairly new practice, halving marks each time in the cryptocurrency world, and the periods leading up to them are an opportunity for speculation and questioning. Because each halving is an event of special significance, reminding us that miners are getting closer and closer to the end of bitcoin – 90% of all bitcoins have already been mined.

Sommaire :

Definition : what is halving?

To “produce” new bitcoins, they have to be mined. In short, the miners are put in competition, and must answer equations. The miner who succeeds first receives a set number of bitcoins as a reward for his work on the blockchain. This amount was set at the conception of bitcoin by Satoshi Nakamoto, the creator of the crypto-currency. In the early days of bitcoin, a miner received 50 bitcoins for each new block. This has since changed: during the first halving in 2012, the reward given to miners dropped to 25 bitcoins. In 2016, at the second halving, it was reduced to 12.5.

The halving of Bitcoin is a process where the number of Bitcoins rewarded to miners for verifying transactions is cut in half, it happens every 210,000 blocks (approximately every 4 years).

Since the last halving in 2020, miners receive “only” 6.25 bitcoins for each new block. At the next halving, which is scheduled to take place in 2024, the payout will drop to 3.125 bitcoins, and so on.

What are the past and future dates (estimates) of halving bitcoin since its creation?

| Halving | Date |

|---|---|

| 1st | November 28, 2012 |

| 2nd | July 9, 2016 |

| 3rd | May 11, 2020 |

| 4th (estimated) | 2024 (approx) |

| 5th (estimated) | 2028 (approx) |

What is the impact of halving on the price of Bitcoin?

The impact of halving on the price of Bitcoin can be summarized as follows: as the reward for mining new blocks is cut in half, the rate at which new bitcoins are added to the market decreases, which can lead to a decrease in supply and an increase in demand, resulting in an increase in the price of Bitcoin. However, it’s worth noting that the relation between halving and price is not a one-to-one relationship, there are many other factors which affect the market.

An expert analysis on the impact of halving on the price of Bitcoin would take into account several factors. One is the market sentiment and the perceived value of Bitcoin at the time of the halving. If investors believe that the cryptocurrency has a bright future, demand for it may increase, driving up the price. Additionally, changes in supply and demand can also play a role. As the reward for mining new bitcoins is cut in half, the rate at which new bitcoins are added to the market decreases, which can lead to a decrease in supply and an increase in demand, resulting in an increase in the price. This relationship is not linear and it depends on how the market reacts to this change. The historical pattern of price increase before and after halving also plays a big role in this phenomenon.

Another important factor is the mining difficulty, as the halving event makes mining less profitable some miners may shut down operations and this will affect the difficulty of mining and can again affect the price.

SEE ALSO: Bitcoin mining has already produced 200 million tons of CO2!

Why was this halving system created?

Unlike traditional currency, Bitcoin has a fixed number of units: it was decided that there would be only 21 million Bitcoins produced. It is this feature that makes it a rare commodity, like gold: there is a limit. And once it’s reached, there will never be another bitcoin mined.

It is this notion of scarcity that gives a product or a metal its value. It was to achieve this aspect of bitcoin that Satoshi Nakamoto decided to set a limit to bitcoin, to create value. This limit of bitcoin has been inserted into the code of the blockchain, and can never be transgressed.

It has been calculated that this limit should be reached in 2140, but the exact date when the last bitcoin will be produced has not yet been defined. At the moment, just over 18 million bitcoins have been mined, which is over 88.3% of the total. And with each halving, it will become more difficult to produce a bitcoin, which maintains the longevity of the blockchain – at least until 2140.

SEE ALSO: How to identify a crypto scam quickly?

How does halving work in practice?

Halving is written into the code. It is planned to occur every 210,000 blocks. Since a block is created every 10 minutes, experts have calculated that the next halving should take place in the spring of 2024 – but nobody has an exact date yet.

Since halving is written into the bitcoin code, there is nothing special to do or organize: it just happens!

In practical terms, the halving does not change the actual production of bitcoin. The difference will only be felt by miners who produce the 210,001st and subsequent blocks, who will receive only 3.125 bitcoins as a reward instead of the usual 6.25 bitcoins.

Why 21 million?

The sum of 21 million bitcoins was chosen by Satoshi Nakamoto – and he never explained why this number was chosen. However, experts have concluded that there are two very likely hypotheses.

The first assumes that Satoshi Nakamoto chose this number because, in 2009, the total amount of money in circulation in the world was 21 trillion dollars. Hoping that bitcoin would one day become the world’s base currency, one bitcoin would then have a fixed value, corresponding to 1 million dollars.

The other assumption is based on the time it takes to mine a block. The parameters of Bitcoin today mean that a block is mined approximately every ten minutes, thanks to a protocol that adjusts the difficulty. The number 21 million would be a mathematical logic, applied simply for the sake of convenience.

SEE ALSO: Metaverse: the new investment that’s on the rise

What are the consequences for bitcoin (BTC)?

The consequences of halving on the bitcoin price are not necessarily felt immediately afterwards, but they are real. The specialized site Investopedia explains that halvings have always corresponded to moments of strong increase in the price of bitcoin. This trend is actually quite logical: the number of bitcoins produced becomes more scarce, which only increases its value.

“The first halving, which occurred in November 2012, took bitcoin’s price from $12 to $1,207 in one year. The second halving occurred in July 2016, when the price stagnated around $650, and a year later, bitcoin experienced its first peak and reached the record price of $16,000.” And the latest halving occurred in May 2020, just a few months before bitcoin broke its previous record and rose to over $63,000.

What happens when there is no more bitcoin?

If the only interest miners have in producing new blocks and ensuring the integrity of the blockchain is to receive payment in bitcoin, what will happen when no more bitcoin is produced?

Although this event is not expected until 2140, many people have already been looking into the subject, as it is a crucial issue. The solution being considered, for the moment, is to pay miners to ensure that the blockchain functions properly. Like a maintenance fee, in a way.

For the moment, miners already receive transaction fees each time an operation is registered on the blockchain. These fees are only a small part of their income, but in the future, they could very well represent the whole of it, which would certainly inflate the prices.

Do other crypto currencies have halvings?

What about the other crypto-currencies? The situation is varied.

Ethereum, the second most popular cryptocurrency behind bitcoin, does not have a set number of units. So for now, there’s no real need to institute halving – but that also means that rewards for miners fluctuate. They usually range in value from 2 ETH to 2.5 ETH, but this has not always been the case. Until 2018, creating a block was rewarded with 3 ETH, before miners decided to voluntarily lower the payout – in order to drive up the price of ethereum. Since then, on the Ethereum Improvment Proposals platform, one user has even suggested gradually lowering the price to 1 ETH.

But other cryptocurrencies have a set number of units. For Monero, the limit is set at 18.9 million, and the currency has implemented a system of gradually reducing the payout over time – a less abrupt change than bitcoin.

SEE ALSO: How to get passive income with stock market investment?

FAQ: What you need to know about the Bitcoin halving process

Halving Bitcoin is a process where the number of Bitcoins rewarded to miners for verifying transactions is cut in half, it happens every 210,000 blocks (approximately every 4 years) and its a mechanism to make sure the supply of bitcoins is limited and thus the value of the currency is maintained.

The impact of halving on the price of Bitcoin can be significant. As the reward for mining new blocks is cut in half, the rate at which new bitcoins are added to the market decreases, which can lead to a decrease in supply and an increase in demand, resulting in an increase in the price of Bitcoin. However, it is important to note that the price of Bitcoin is affected by a variety of factors and past performance is not necessarily indicative of future results.

Halving affects the mining process by making it more difficult and less profitable for miners to generate new blocks. As the reward for mining new blocks is cut in half, the rate of return for miners decreases, which can lead to some miners shutting down their operations and others investing in more efficient mining equipment to stay profitable. It also means the mining process becomes more centralized as smaller miner will not be able to survive and only big mining farm with economy of scale will remain.

The maximum number of bitcoins that will ever exist is 21 million. This number was established by the Bitcoin protocol’s creator, Satoshi Nakamoto, and is hard-coded into the software. Once this limit is reached, no more new bitcoins will be created and the total supply of bitcoins will not exceed 21 million.

The significance of this number is that it ensures scarcity of the currency, similar to precious metals like gold. By limiting the total supply of bitcoins, the value of each bitcoin is kept artificially high, as there will always be more demand for a limited supply. This scarcity also ensures that bitcoin maintains its purchasing power over time and does not get affected by inflation. It also makes sure that as number of bitcoin reduces, the mining process will become more difficult and less profitable and only the big miner with economy of scale will remain and it leads to more centralization in the system.